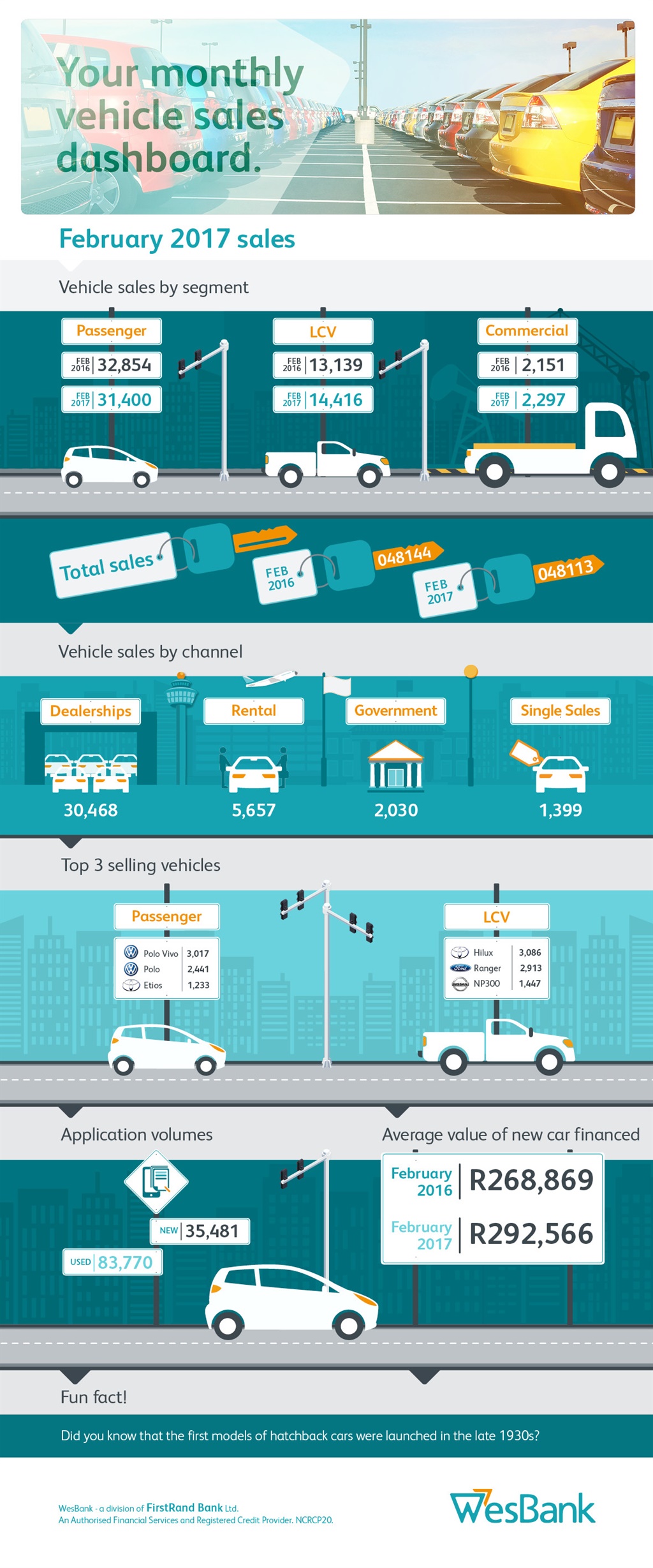

Johannesburg - February’s total new vehicle sales saw a negligible year-on-year decline of 0.1%, with sales of 48 113 units.

Despite growth in the commercial segments, total passenger car sales fell 4.4%, year-on-year. Passenger car sales through the dealer channels slumped 5%.

Total sales through the rental channel grew 32.5% year-on-year.

READ: 'Positive' SA vehicle sales for February 2017 - Naamsa

Finance specialist WesBank reports that February saw demand for new vehicles drop 8.4% year-on-year. Demand for used vehicles also slowed, with 5.3% fewer applications received compared to February 2016. Consumers who did finance vehicles also paid more; the average deal value for a new car was 8.8% higher, while the average car was 9% more expensive year-on-year.

Image: Wesbank

Finance specialist Absa adds the following:

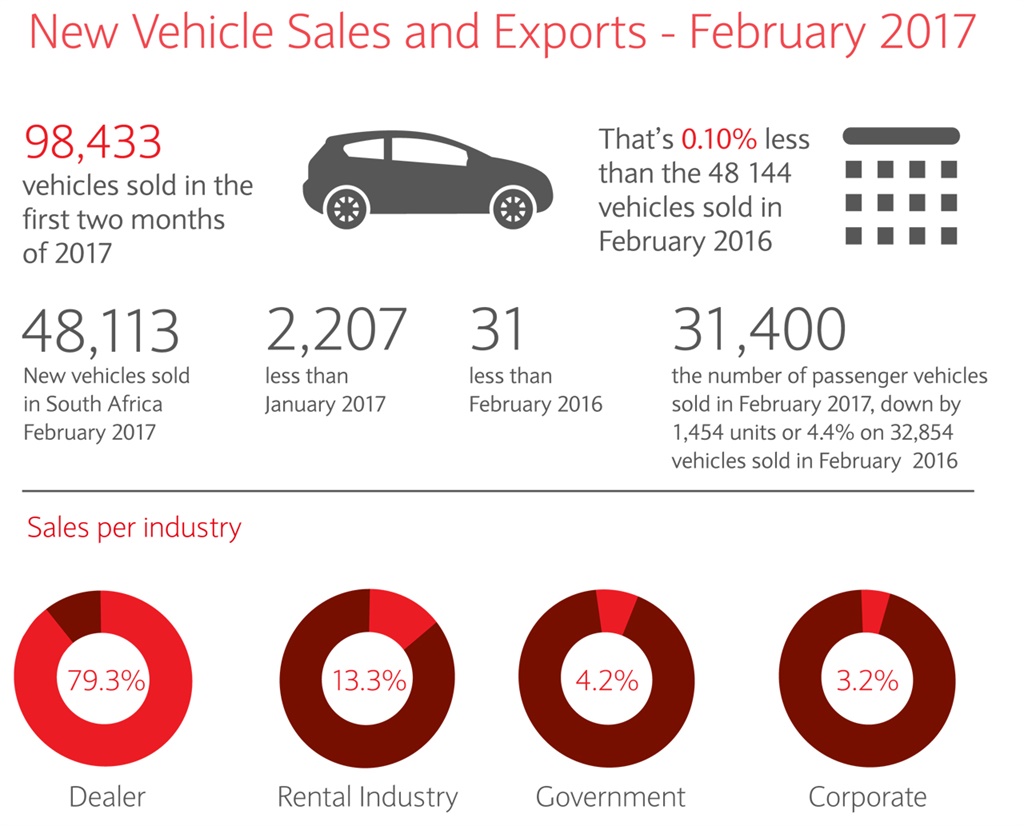

Vehicle Sales and Exports

• New vehicle sales contracted by 0.1% year-on-year (y/y) and 4.4% month-on-month (m/m) to 48 113 units in February 2017.

• New passenger car sales volumes (65.3% of total sales) slowed down by 4.4% y/y and 14.7% m/m to a level of 31 400 units in February.

• New commercial vehicle sales increased by a relatively strong 9.3% y/y and 23.6% m/m to 16 713 units in February, with light commercial vehicle (LCV) sales (30.0% of total sales) rising by 9.7% y/y and 20.3% m/m to 14 416 units last month.

READ: SA's top-selling bakkies - Hilux wrestles top spot from Ranger in Feb

• The overall new vehicle daily sales rate came to 2 291 units in February compared with 2 396 units in January.

• New vehicles sales by dealers amounted to 79.3% of total sales volumes in February, followed by 13.3% of sales to the rental industry, 4.2% to the government and 3.2% to corporate fleets.

• New vehicle exports increased by 0.2% y/y and 152.2% m/m to 29 388 units in February.

Vehicle Finance

• Vehicles are still mostly financed over a 72-month period with used vehicles only marginally impacting the average financing term. The main driver of this remains affordability, but it has the downside of an ever-increasing average contract period, which continues to lengthen the vehicle replacement cycle.

• A total of 44 922 vehicles were financed in January 2017 (28 511 in January 2016), of which 31 954 were used vehicles (18 597 in January 2016) and 13 038 were new vehicles (9914 in January 2016). This resulted in a used-to-new ratio of 2.45 in January this year (1.88 in January 2016).

READ: SA car sales - Polo Vivo on top, Focus joins top 10 best-sellers

Image: Absa

Industry Outlook

• Sales volumes of new vehicles are projected by Naamsa to rise by 3.5% in 2017 after a drop of around 11% in 2016. Macroeconomic conditions and the state of consumer and business sector finances and confidence will be the main drivers of vehicles sales in the rest of the year.

• At an industry level, new vehicle sales volumes will be dependent on the demand for entry-level passenger cars, new model releases and manufacturer incentives.

• Global economic growth and vehicle demand, local manufacturers’ export programs and exchange rate movements, affecting vehicle export competitiveness, will remain important factors of new vehicle exports this year.

READ: SA car sales - Toyota dominates luxury SUVs in February

• Interest rates are forecast to remain unchanged at current levels throughout 2017, with rate movements to be highly dependent on trends in relevant economic and financial market data. Interest rates are an important factor affecting the affordability of and the demand for and growth in vehicle finance.

• According to data published by Statistics South Africa data, new vehicle price inflation measured 9.7% y/y in January this year, down from 10.5% y/y in December last year. However, in view of expected rand exchange rate weakening towards the end of the year, new vehicle prices are forecast to remain under pressure, which will have a negative effect on new vehicle affordability.

Consumer outlook

• The financial strain experienced by consumers during 2016 is expected to continue in 2017 against the background of inflationary pressures, interest rates to remain stable at current levels, low economic and employment growth and tax hikes announced in the Budget.

Image: Absa

Factors affecting the auto industry

• Vehicle prices: New vehicle price inflation will be reflected by rand exchange rate movements.

• Household finances, consumer and business confidence: Household finances remain finely balanced against the background of debt levels and a significant percentage of credit-active consumers having impaired credit records. Consumer and business confidence remains low in view of economic developments and prospects.

• Vehicle finance: The demand for and affordability and accessibility of vehicle finance, largely driven by interest rate movements, customer credit-risk profiles and consumer and business confidence, are key to the performance of vehicle sales and growth in vehicle finance.

• Transport costs: Fuel prices and vehicle maintenance costs drive transport costs and consumer price inflation, impacting consumer and business spending power.

• Vehicle demand and supply: Global and domestic economic growth drive vehicle exports and local sales, which are supported by manufacturers’ export programs. Labour market trends and developments impact vehicle production and export volumes, with vehicle export competitiveness driven by rand exchange rate movements.

Publications

Publications

Partners

Partners