• Vehicle sales in South Africa are seeing steady improvements.

• 33 000 new vehicles are sold monthly following April's below-1000 slaughter.

• NADA looks at Covid-19 and its impact wholly.

• For more motoring stories, go to www.Wheels24.co.za

There is a natural tendency for South Africans to look at the negative aspects of the nation's economy under Lockdown, but if we look on the brighter side, green shoots are in plain view.

At the National Automobile Dealers' Association (NADA), we are pleased with South Africa's handling of the pandemic crisis. In mid-September, the seven-day average rate was 1627 infections per day and is currently below 1000, which is vastly different from the peak of 13 944 infections per day on 24 July.

The result of this massive decline has been a move to Lockdown Level 1, with doors opening for the under-pressure travel and tourism markets. This positivity is especially crucial as Lockdown risk and stress are economic inhibitors linked directly to purchase decisions by consumers and investments by businesses.

Hand sanitiser and face masks have become common practice in 2020 (Freepik)

Critical indicators

One of the most critical indicators for the motor industry is the record-low interest rates. This could be a game-changer going forward if the Reserve Bank can maintain the current low levels for the next two years. The automotive industry could see hugely positive results as consumer appetite for bigger-ticket items ramps up in the wake of decreased total finance costs.

This situation is already having a significant effect on specific sectors, particularly in the residential housing market.

Huizemark Group MD, Bryan Biehler, has shared interesting information obtained from a recent survey which showed impressive residential dwelling sales volumes for the past three months. Levels in some months have been even higher than pre-Lockdown, indicating pent-up demand in a buyer's market.

Biehler says: "Indicative mortgage bond production data coming from the market showed a natural decline due to Lockdown. The same data shows bond values in July and August are up 50% on pre-Covid levels. This is brilliant news for our economy as the low interest rate has created a favourable investment and buying climate."

Demand is particularly strong in the under R2.0-million segment, where mortgage rates are similar to rental costs. The banks are also reputedly granting loans in the above-R3.0-million market with relative ease.

House with pool and lavish garden (YOU)

Low inflation rate

Fortunately, South Africa also has a low inflation rate, which was running at just over 2% until 28 August when the Consumer Price Index (CPI) jumped to 3.2% year-on-year, mainly due to fuel price and municipal tariff hikes in recent times.

However, inflation needs to be slightly higher and closer to the Reserve Bank's band of 3-6% as it is a measure of economic strength. It is important to note that the rand exchange rate is holding up comparatively well, following a ratings downgrade to junk and the huge GDP tumble, but the rate did not reach the R20 to the US dollar mark that had previously been predicted by some financial experts.

More good news is that mining stocks have shown a 300% increase in Earnings Before Interest, Taxes, Depreciation and Amortisation (EBITDA), which is seen as a proxy for cash flow in that business sector. Agriculture is also doing well, as producers have had lots of rain in essential regions of the country, together with six months of good sales volumes and good prices during Lockdown.

Another positive indicator for the retail motor industry is the increasing traffic flow in urban areas and on the highways. At the same time, TomTom has indicated that households are at about 90% of the kilometres travelled pre-Covid-19.

Traffic in South Africa (Wheels24 archives)

A fortunate position

South Africa is in the fortunate position where it can source funds, from organisations such as the International Monetary Fund, World Bank, African Development Bank and New Development Bank, which are willing to loan money to allow the rebuilding of the economy.

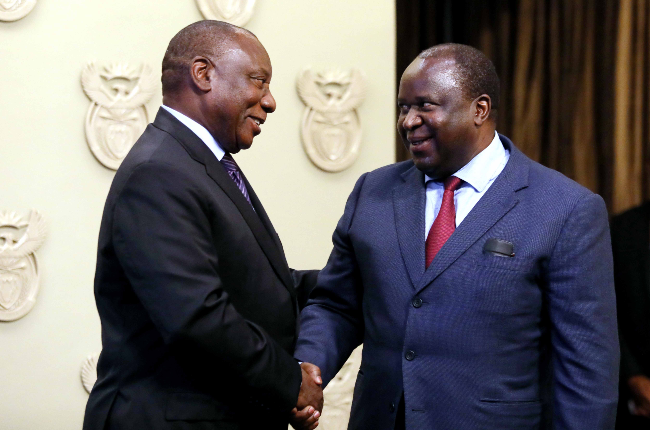

Another positive indicator was that President Cyril Ramaphosa had survived an important 'long knives' meeting of the ANC National Executive Committee recently, while Finance Minister Tito Mboweni's stoicism and consistent message from Treasury is also welcomed.

I am, however, a realist and don't just look at the world through rose-tinted spectacles. If we look at other macro-economic factors, the biggest shock psychologically was a record 51% fall in the Gross Domestic Product (GDP) in the second quarter - but this was expected, and we have moved on from there.

President Cyril Ramaphosa (left) and finance minister Tito Mboweni (News24)

Significant upticks

These numbers are dated, and there have been significant upticks in the economy, with an important one for us being a jump from selling less than 1000 cars in April, to now selling roughly 33000 cars a month consistently. Used vehicles are also selling strongly. Our ongoing commitment to maintaining strict safety and hygiene protocols at our dealerships in our effort to keep the disease at bay goes without question.

Yes, there are ongoing concerns such as rising oil prices, a big budget deficit expected from tax collection, lack of take-up on government bonds, the unreliable power supply from deeply-indebted Eskom, as well as the impact expected from major international events such as the American election and Brexit, but I am still confident we can weather this storm.

We seem to have quickly forgotten the dire state we were in during April, and I am sure we are all glad that we now trade in a far more stable environment. In my role as chairman of NADA and as the person responsible for several dealerships I always look at business in quarters, never months or weeks so that I can see the bigger picture, not blips in isolation.

I don't see vehicle sales volumes growing quickly in the short term. However, I think many of us have taken the opportunity to right-size our businesses. We must now take advantage of our new-found agility to react to changing conditions, which include the welcome lowering of interest rates and banks' loan approval rates holding up and, in fact, being generally better than expected.

Mark Domisse is the chairman of the National Automobile Dealers' Association.

Mark Dommisse (NADA)

Publications

Publications

Partners

Partners