There are more than over 11 million registered vehicles in South Africa (excluding caravans and trailers) yet the majority of these vehicles, about 60-70%, are uninsured, reports the Automobile Association (AA).

The Road Traffic Management Corporation (RTMC) indicates there are more than 800 000 crashes in South Africa annually.

The AA said: "Based on the insurance statistics, this equates to around 520 000 cars which are involved in crashes and which are uninsured."

What has been your experience with car insurers in SA? Email us

Motorists who are opting to have insurance, are often choosing insurance based on the lowest available premiums, rather than understanding the benefits and disadvantages of the insurance they are considering buying.

The AA warns: "It is sometimes difficult to get insurance which matches your pocket, and which gives you the cover you need or want. For this reason, it is necessary for motorists to read their policies carefully, and to understand all the aspects of the insurance they are planning on taking. Too often, low premiums sound good but fall short when claims are made."

Image: iStock

What’s car insurance excess?

A good example is the excess fee which may be payable when a claim is made. An excess is a fee you pay towards a claim for loss or damage to your car, regardless of who is to blame. A company offering a low monthly premium, for instance, may require a substantial excess in the case of loss or damage.

The AA explains: "When this happens some people are shocked when the costs of repair to a vehicle may be carried entirely, or in part, through the excess fee, with little or no money being paid by the insurer. Lower monthly premiums in this case will not count for much as the motorist still has to pay a big portion of the costs out of their own pocket."

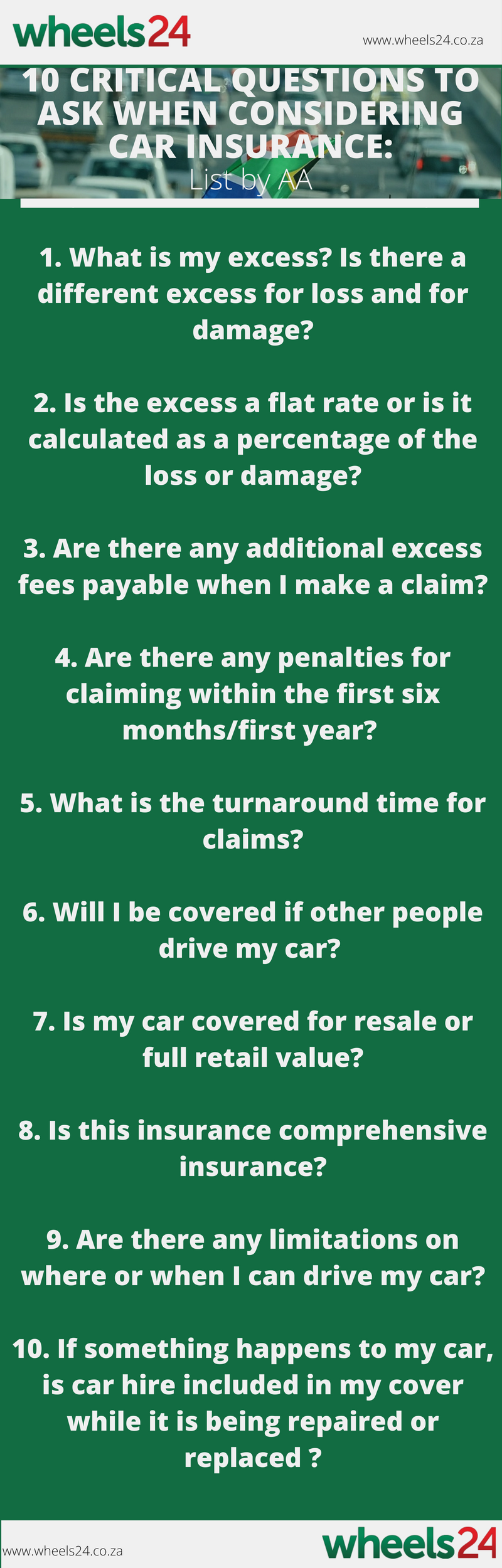

The Association says motorists who want to insure their vehicles must understand the terminology of their contracts, and ask for clarification of any unclear clauses before committing to a specific insurance policy.

The AA said: "Insurance is a necessity but it is more important that when taking out insurance motorists understand exactly what they are getting, and how much it will cost them if they do claim."

Publications

Publications

Partners

Partners